The e-commerce landscape in 2026 has fundamentally changed how businesses access capital. Whether you're an amazon fba seller struggling with inventory costs or an ecommerce business looking to scale rapidly, traditional bank loans no longer cut it.

Amazon cashflow issues hit harder than ever. Amazon's payment cycles, inventory demands, and seasonal fluctuations create a perfect storm for cash-strapped sellers. Meanwhile, investors are discovering that ecommerce investment opportunities extend far beyond buying stocks in Amazon or Shopify.

This guide breaks down every financing option available to amazon fba sellers and e-commerce businesses in 2026: plus reveals how smart entrepreneurs and investors are using Consumer Goods Exchange (CGX) to revolutionize ecommerce financing entirely.

The E-Commerce Cash Flow Crisis Nobody Talks About

Your amazon business is growing, but your bank account isn't keeping pace. Sound familiar?

Amazon fba sellers face unique challenges that traditional financing simply can't solve:

- Inventory pre-funding: You pay suppliers 30-60 days before Amazon pays you

- Seasonal spikes: Q4 demands massive inventory investment with delayed returns

- Account holds: Amazon can freeze funds without warning, killing your amazon cashflow

- Growth paradox: The faster you grow, the more cash you need upfront

Traditional banks don't understand ecommerce cashflow patterns. They see irregular deposits and get nervous. They want collateral you don't have and personal guarantees that put your home at risk.

Traditional Financing Options: The Old Guard

Bank Loans and Lines of Credit

Pros: Low interest rates, established process

Cons: Lengthy approval (2-6 months), strict requirements, personal guarantees

Banks still operate like it's 1995. They want three years of financials, perfect credit scores, and collateral worth more than your loan. For amazon fba sellers with fluctuating revenues, this creates an impossible barrier.

SBA Loans

Pros: Government backing, competitive rates

Cons: Paperwork nightmare, 60-90 day approval times, restrictive use requirements

SBA loans work great for brick-and-mortar businesses buying equipment. For ecommerce investment in inventory that turns every 30 days? Not so much.

Venture Capital and Angel Investment

Pros: Large capital amounts, mentorship, industry connections

Cons: Equity dilution, loss of control, lengthy due diligence process

VC works if you're building the next Amazon. For most amazon business owners moving products, giving up 20-40% equity for working capital makes zero financial sense.

Alternative Financing: The Game Changers

Revenue-Based Financing (RBF)

RBF ties repayments to your monthly revenue. When sales are high, you pay more. When sales dip, payments automatically adjust.

Perfect for: Amazon fba sellers with predictable revenue streams

Typical terms: 6-24 months, 6-30% total cost of capital

Companies like Shopify Capital have deployed over $5 billion through RBF since 2016. The model works because it aligns with ecommerce cashflow patterns instead of fighting them.

Inventory Financing

Use your inventory as collateral for working capital. As you sell products, the loan balance decreases automatically.

Perfect for: Established amazon fba sellers with consistent inventory turnover

Typical terms: 30-180 days, 1-3% monthly fees

Invoice Financing

Convert unpaid customer invoices into immediate cash. Particularly useful for B2B ecommerce businesses with net-30 or net-60 payment terms.

Perfect for: B2B sellers with reliable customers

Typical terms: 1-5% factor fee, 24-48 hour funding

Amazon-Specific Financing Solutions

Amazon Lending

Amazon's internal lending program offers amazon fba sellers capital based on selling history and performance metrics.

Pros: Fast approval, competitive rates, no personal guarantees

Cons: Invitation-only, loan amounts often insufficient for growth needs

Marketplace Lending Platforms

Specialized lenders like Payability, BlueVine, and Clearco focus specifically on amazon seller financing. They connect directly to your seller account and assess risk using real-time sales data.

Typical offering: 2-12 month terms, funding within 24-48 hours, 6-36% APR depending on performance

The CGX Revolution: Beyond Traditional Financing

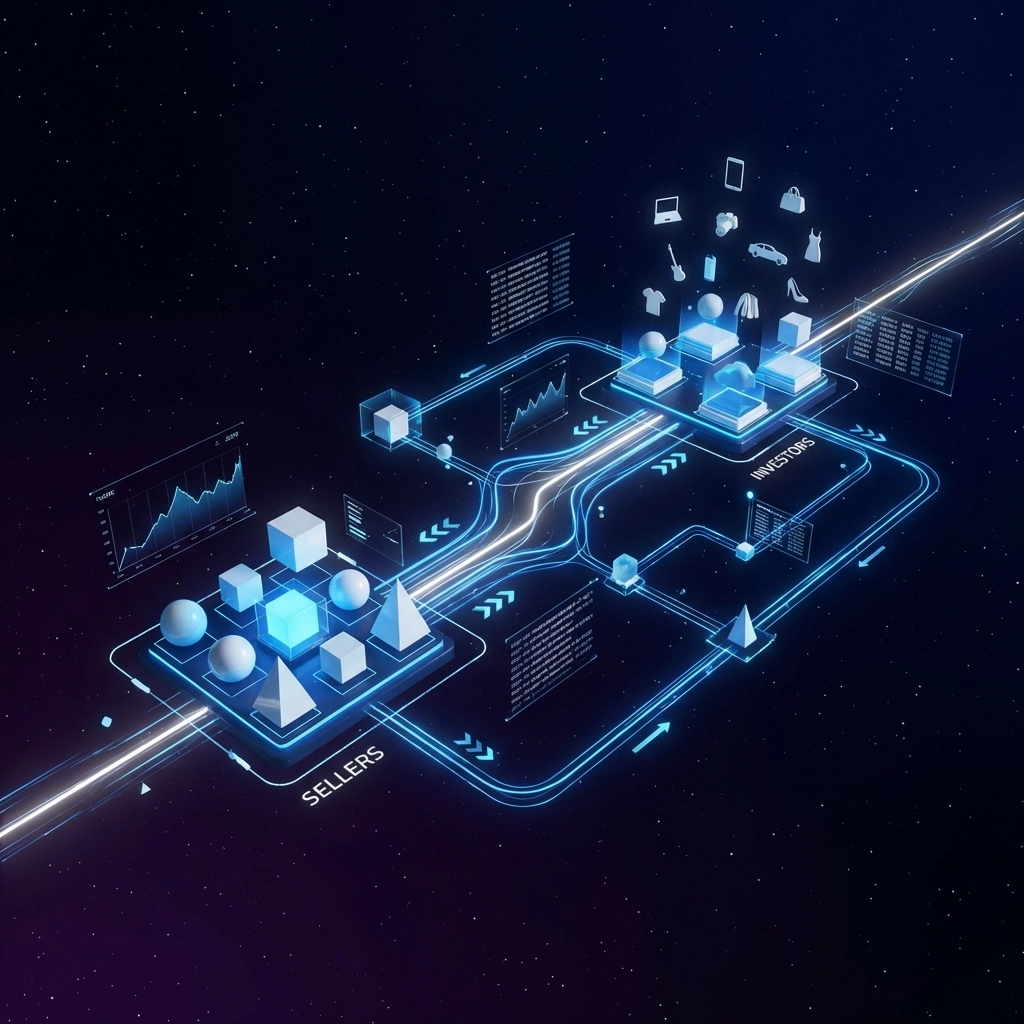

While other businesses struggle with debt and equity dilution, Consumer Goods Exchange (CGX) offers a completely different approach to ecommerce financing.

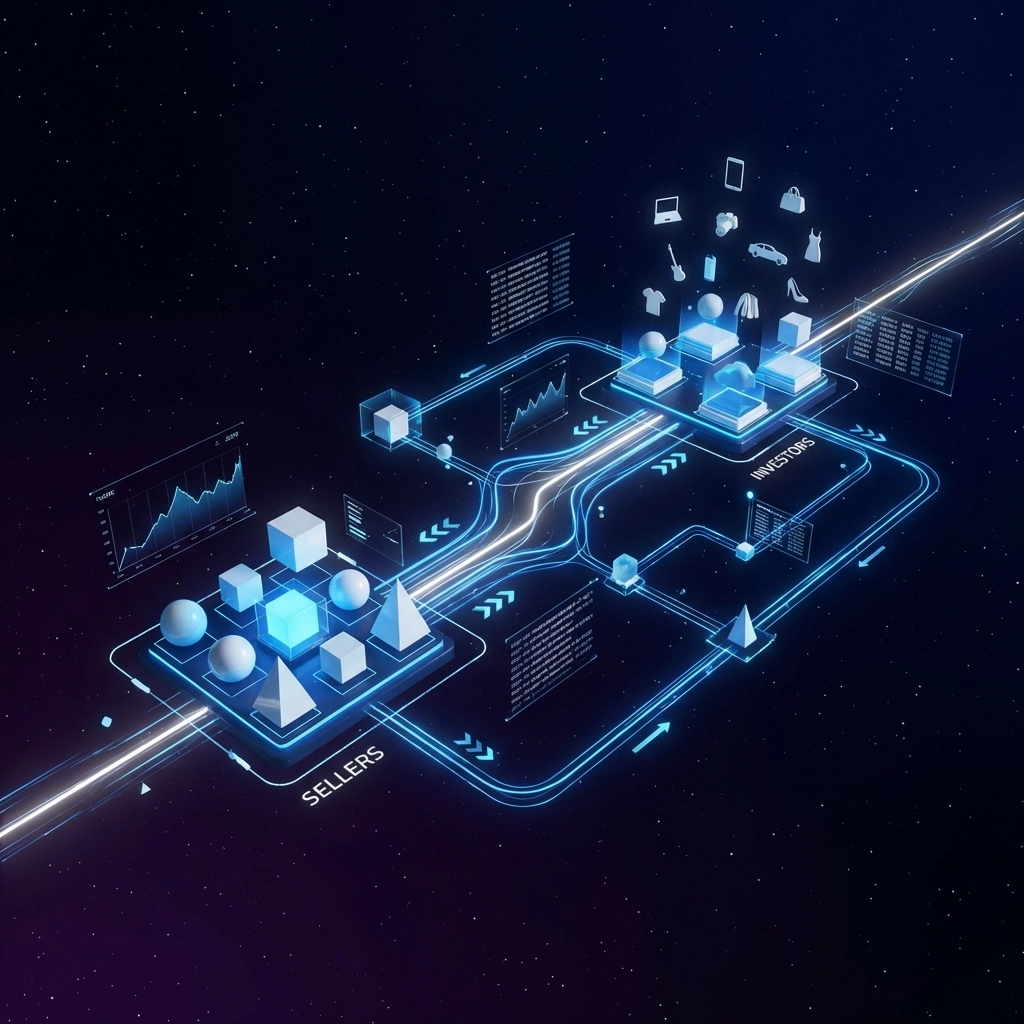

Instead of loans, amazon fba sellers can sell rights to future sales directly to investors on CGX's trading platform. Here's how it works:

For E-Commerce Sellers

Sell future sales rights: Instead of borrowing money, you sell a percentage of future product sales to investors for immediate cash.

No debt, no equity dilution: You keep 100% ownership of your business. No monthly payments, no personal guarantees, no collateral requirements.

Instant liquidity: Convert future amazon cashflow into working capital today. Fund inventory, marketing, or expansion without waiting for payment cycles.

Risk sharing: Investors share both upside and downside. If sales exceed projections, they benefit. If sales disappoint, that's their risk: not yours.

For Investors

Direct exposure to consumer goods markets: Instead of buying Amazon stock, investors can buy rights to specific product lines from amazon fba sellers.

Diversified portfolio: Spread ecommerce investment across multiple sellers, product categories, and seasonal cycles.

Transparent performance tracking: Real-time sales data, inventory levels, and market performance through CGX's platform.

Liquid markets: Unlike traditional private equity or venture capital, CGX creates liquid markets where ecommerce investment positions can be traded 24/7.

How CGX Solves Traditional Financing Problems

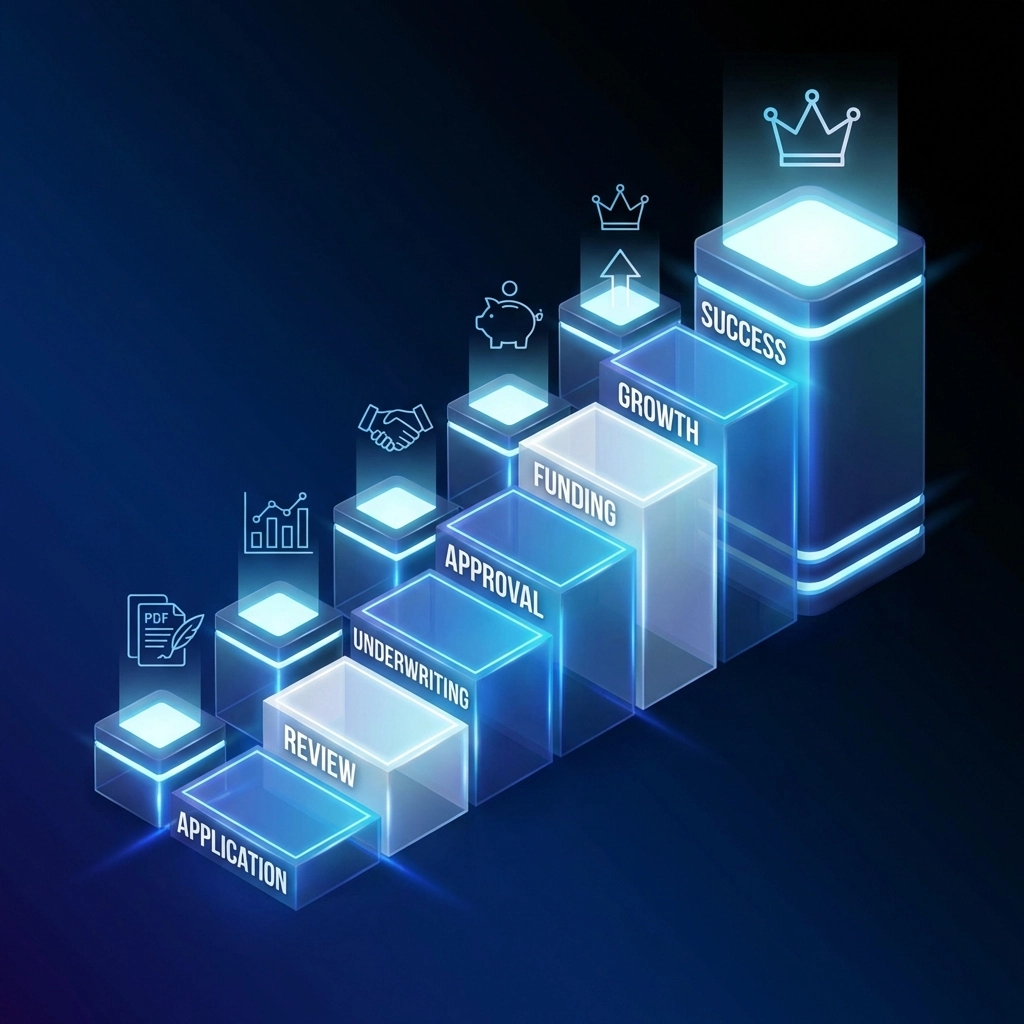

Speed

Traditional loans: 30-90 days approval

CGX: List your future sales rights in 24-48 hours

Requirements

Traditional loans: Credit scores, financials, collateral

CGX: Sales history and product performance data

Risk

Traditional loans: Personal guarantees, business assets at risk

CGX: Investors assume market risk, sellers retain business ownership

Flexibility

Traditional loans: Fixed monthly payments regardless of performance

CGX: Payments linked directly to actual sales performance

Visit CGX's seller program to see if your amazon business qualifies for future sales rights listing.

Choosing the Right Financing for Your Business

Early Stage Amazon FBA Sellers

Best options: Amazon Lending, marketplace lenders, revenue-based financing

Why: Lower barriers to entry, approval based on Amazon performance metrics rather than credit history

Established E-Commerce Businesses

Best options: Lines of credit, inventory financing, CGX future sales rights

Why: Higher capital needs, proven track records enable better terms and more sophisticated structures

High-Growth Amazon Businesses

Best options: CGX platform, venture capital (if building beyond Amazon)

Why: CGX provides growth capital without equity dilution; VC adds strategic value for businesses expanding beyond e-commerce

Seasonal or Cyclical Businesses

Best options: CGX, revenue-based financing, flexible lines of credit

Why: Payment structures that flex with seasonal ecommerce cashflow patterns

Investment Opportunities in E-Commerce Financing

Smart investors are moving beyond traditional ecommerce investment approaches. Instead of buying shares in public companies, they're investing directly in consumer goods futures through platforms like CGX.

Why Consumer Goods Futures Beat Traditional Stocks

Direct correlation: Your returns directly reflect consumer demand for specific products, not market sentiment about tech valuations.

Diversification: Spread investments across different product categories, seasonal cycles, and geographic markets.

Transparency: Real-time sales data, inventory levels, and market performance: no waiting for quarterly earnings reports.

Lower minimums: Start investing in amazon fba seller performance with smaller capital requirements than traditional private equity.

Liquidity: Trade positions 24/7 on CGX's platform rather than being locked into illiquid private investments.

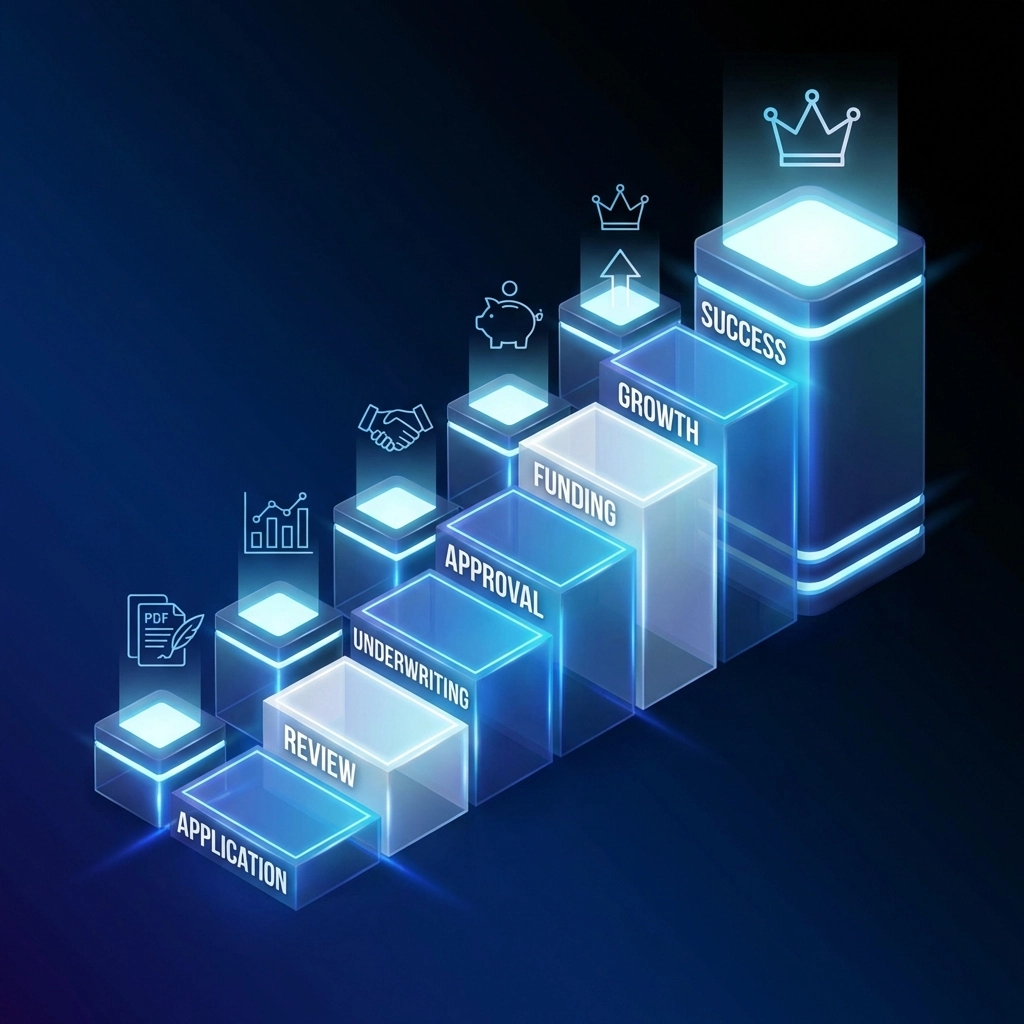

Getting Started: Next Steps for Sellers and Investors

For E-Commerce Sellers

-

Assess your capital needs: Calculate inventory requirements, marketing budgets, and growth capital needs for the next 12 months.

-

Evaluate your options: Compare traditional loans, alternative financing, and CGX future sales rights based on cost, speed, and risk.

-

Prepare your data: Gather Amazon seller performance metrics, sales history, and product performance data.

-

Start with CGX: Visit uscgx.com to explore selling future sales rights without debt or equity dilution.

For Investors

-

Research the market: Study ecommerce investment trends, seasonal patterns, and product category performance.

-

Start small: Begin with smaller positions across multiple sellers to understand market dynamics.

-

Join CGX platform: Create your investor account and explore available amazon fba seller opportunities.

-

Monitor performance: Use CGX's real-time tracking tools to optimize your consumer goods investment portfolio.

The Future of E-Commerce Financing

2026 marks a turning point in ecommerce financing. Traditional debt-based models are giving way to innovative platforms that align investor interests with seller success.

Amazon fba sellers no longer need to choose between slow bank approval processes and high-cost alternative lenders. Platforms like CGX create win-win scenarios where sellers access immediate capital while investors gain direct exposure to consumer goods markets.

The question isn't whether alternative financing will replace traditional methods: it's whether your business will adapt fast enough to capitalize on these opportunities.

Ready to transform your e-commerce financing approach?

Visit Consumer Goods Exchange today to explore how selling future sales rights can solve your amazon cashflow challenges without debt or equity dilution. Whether you're an amazon fba seller needing growth capital or an investor seeking ecommerce investment opportunities, CGX provides the platform to connect, trade, and prosper in the consumer goods economy.

0 Comments