Running an amazon fba business shouldn't mean drowning in debt just to scale. Yet most amazon fba sellers get trapped in expensive loan cycles that eat into profits and create unnecessary stress. The good news? There are smarter ways to fuel your amazon business growth without traditional financing headaches.

Let's explore seven proven strategies that successful ecommerce entrepreneurs use to secure amazon seller capital while keeping their businesses debt-free and profitable.

1. Trade Future Sales Rights Through CGX

The most innovative approach to amazon seller financing doesn't involve loans at all. Instead, you can trade future sales rights on platforms like Consumer Goods Exchange (CGX), where amazon cashflow becomes an immediate asset rather than a distant promise.

Here's how it works: You list a portion of your future sales revenue on CGX, and investors purchase these rights upfront. You get instant capital, they get returns when those sales materialize. No interest rates, no monthly payments, no debt on your books.

Real example: An eco-friendly personal care seller needed $50,000 for inventory expansion. Instead of taking a business loan, they traded 60 days of future sales rights on CGX and secured the capital within 48 hours. The investor earned returns as sales came in, while the seller avoided debt entirely.

2. Reinvest Profits Systematically

The simplest ecommerce financing strategy is also the most overlooked. Instead of viewing profits as personal income, treat them as fuel for growth. Amazon investment in your own business generates the highest returns when done strategically.

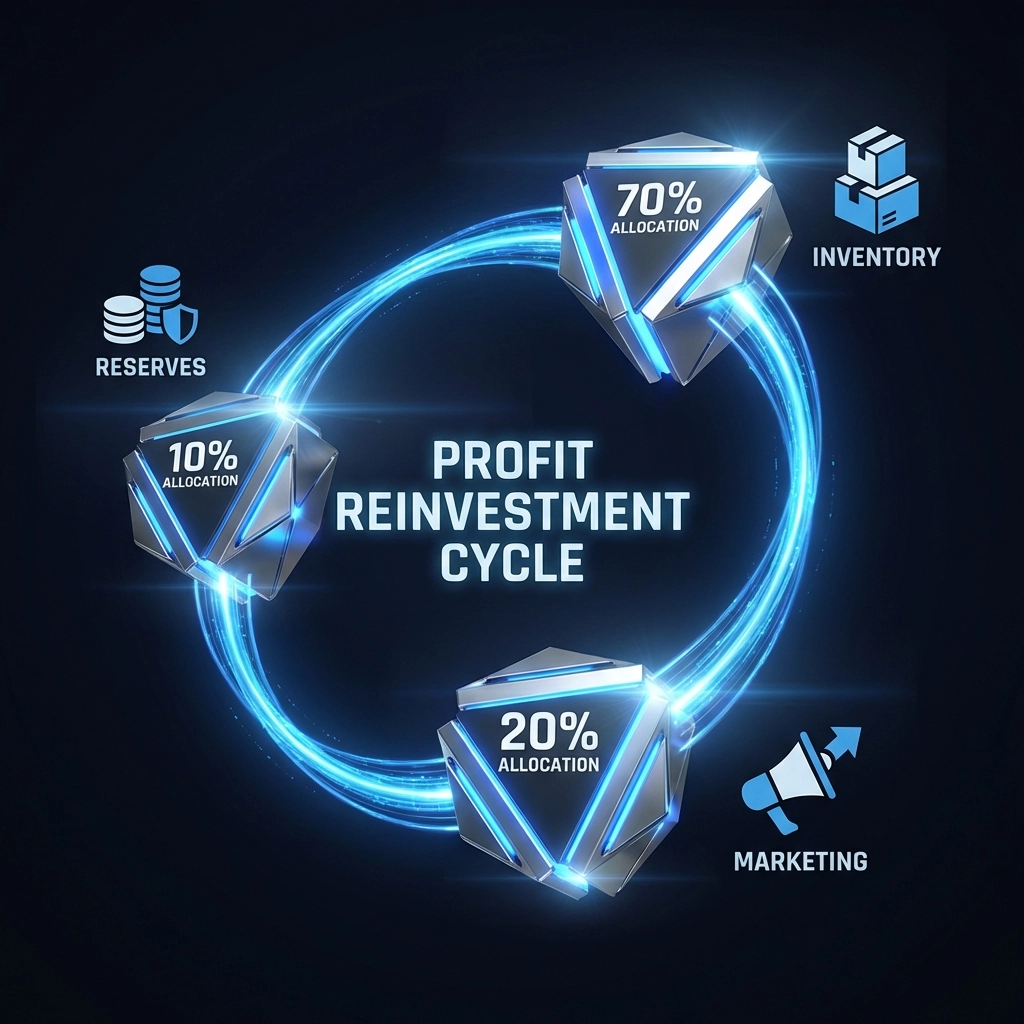

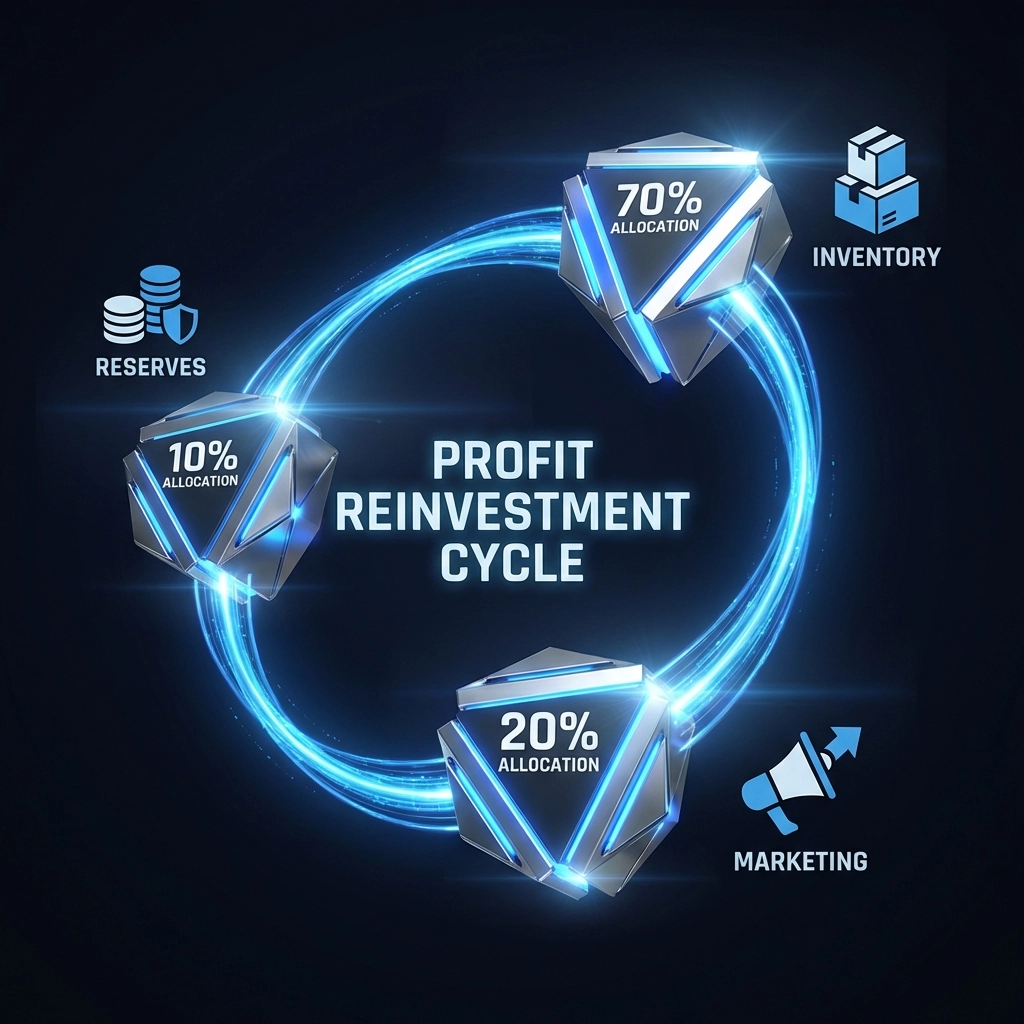

Create a profit allocation system:

- 70% back into inventory and marketing

- 20% for operational improvements

- 10% for emergency reserves

This approach requires patience but builds sustainable ecommerce cashflow without external dependencies. Many successful amazon fba sellers scale from $10K to $100K monthly using nothing but reinvested profits.

3. Leverage Supplier Payment Terms

Transform your supplier relationships into amazon seller capital by negotiating extended payment terms. Instead of paying upfront for inventory, arrange 30, 60, or even 90-day payment windows.

Strategy breakdown:

- Use your sales history to demonstrate reliability

- Offer slightly higher unit costs in exchange for extended terms

- Start with smaller orders to build trust

- Gradually negotiate better terms as the relationship develops

This approach essentially gives you free financing from suppliers who want your continued business. Your amazon cashflow improves immediately since you're selling products before paying for them.

4. Partner with Complementary Businesses

Joint ventures and partnerships create ecommerce investment opportunities without traditional funding. Find businesses with complementary products or customer bases and structure mutually beneficial arrangements.

Partnership models that work:

- Cross-promotion agreements where each business promotes the other's products

- Bundling partnerships that create new revenue streams

- Shared marketing costs for expensive advertising campaigns

- Inventory sharing for seasonal or regional products

These partnerships often provide access to new markets and customers while splitting costs and risks.

5. Implement Pre-Order and Crowdfunding Strategies

Turn your amazon business into a pre-funded operation by collecting payments before producing or ordering inventory. This approach works particularly well for:

- Seasonal products with predictable demand patterns

- Unique or innovative items that generate excitement

- Limited edition variations of existing successful products

- Bundle packages that combine multiple products

Use your existing customer base to gauge demand and secure upfront payments. Social media, email lists, and Amazon's own platform can drive pre-orders that fund your next inventory cycle.

6. Monetize Your Data and Experience

Your amazon fba journey has generated valuable insights that other entrepreneurs will pay for. Transform your knowledge into ecommerce investment capital through:

Information products:

- Course creation about your niche or selling strategies

- Consulting services for newer sellers

- E-books sharing your specific expertise

- Workshop hosting for local entrepreneur groups

Service offerings:

- Product sourcing assistance for other sellers

- Amazon listing optimization services

- Marketing campaign management

- Brand development consultation

This creates additional revenue streams that don't require inventory investment while positioning you as an authority in your space.

7. Utilize CGX's Investor Network for Strategic Partnerships

Beyond simple sales rights trading, CGX's platform connects amazon fba sellers with investors interested in deeper ecommerce investment relationships. These aren't traditional lenders – they're business partners who understand amazon cashflow dynamics.

What makes CGX partnerships unique:

- Transparent trading where both parties see real sales data

- Flexible terms that adapt to your business cycles

- No equity dilution – you maintain full ownership

- Passive income opportunities for investors in proven amazon businesses

The platform's real-time trading capabilities mean you can secure funding when opportunities arise, not weeks later after lengthy approval processes. This responsiveness is crucial for ecommerce success where timing often determines profitability.

Making Smart Capital Decisions

Amazon seller capital strategies work best when combined thoughtfully. Most successful amazon fba sellers use multiple approaches simultaneously:

- Immediate needs: CGX trading for fast capital access

- Medium-term growth: Profit reinvestment and supplier terms

- Long-term expansion: Strategic partnerships and knowledge monetization

The key is matching your funding strategy to your specific growth phase and market conditions. Unlike debt financing, these approaches scale with your success rather than creating fixed obligations regardless of performance.

Why Traditional Financing Falls Short

Conventional amazon seller financing through loans or credit lines creates several problems:

- Fixed payments regardless of seasonal sales fluctuations

- Personal guarantees that risk personal assets

- Restrictive covenants that limit business flexibility

- Interest accumulation that reduces actual profits

- Credit requirements that exclude many profitable businesses

Smart ecommerce financing adapts to your business reality rather than forcing your business to adapt to rigid payment schedules.

Getting Started with Debt-Free Growth

Ready to implement these amazon investment strategies? Start with the approach that matches your current situation:

If you need capital immediately: Explore CGX's sales rights trading for fast access to ecommerce cashflow.

If you have steady profits: Implement systematic reinvestment while negotiating better supplier terms.

If you have unique expertise: Begin monetizing your knowledge while building strategic partnerships.

The most successful amazon businesses combine multiple strategies, creating resilient funding systems that support growth without creating financial stress.

For investors interested in ecommerce investment opportunities, CGX provides transparent access to proven amazon fba revenue streams without the complexity of traditional business investments.

Your Next Steps

Amazon seller capital doesn't have to come from banks or credit cards. The strategies outlined here have helped thousands of ecommerce entrepreneurs scale their businesses while maintaining financial freedom.

Start by exploring CGX's platform to see how trading future sales rights can provide the amazon cashflow you need for immediate growth opportunities. The platform's transparent trading environment benefits both sellers seeking capital and investors looking for ecommerce investment returns.

Additional resources:

Transform your amazon fba business from debt-dependent to financially independent. Join CGX today and discover how innovative funding creates sustainable growth for both sellers and investors in the evolving ecommerce landscape.

0 Comments