Your amazon fba business is bleeding cash, and traditional solutions aren't cutting it anymore.

Amazon's 2026 fee increases and payout delays are creating the perfect storm for ecommerce cashflow problems. While most amazon fba sellers scramble for expensive loans, smart business owners are discovering a revolutionary approach that turns future sales into immediate capital: without debt.

The 2026 E-Commerce Cashflow Crisis is Real

Amazon business owners face unprecedented challenges this year. Starting January 15, 2026, Amazon FBA fees increased by $0.08 per unit for standard-size items priced $10-$50. But that's just the beginning.

The real killer? Amazon's new DD+7 payout policy launching March 12, 2026. Your payouts now get delayed until seven days after delivery instead of after shipment. This creates a devastating cash gap: fees go up immediately, but your money gets delayed even longer.

For a typical amazon fba seller doing $100K monthly, this creates a $3,000-$5,000 cash shortfall every month. That's enough to kill your amazon investment returns and force you into expensive financing.

Immediate Actions to Stop the Bleeding (Next 30 Days)

Calculate your fee impact now. Every day you wait costs margin. Use Amazon's fee calculator for each SKU to identify products becoming unprofitable. Run these numbers today: not tomorrow.

Audit your catalog ruthlessly. Cut underperforming SKUs where margins are getting crushed. Better to eliminate weak products now than bleed money all year.

Fix shipment accuracy immediately. Defect fees increased 1,600%. One mislabeled shipment could erase a month's profit from your amazon business.

Negotiate supplier terms. Push for net-45 or net-60 payment terms to extend your cash runway while Amazon squeezes your payouts.

Why Traditional Amazon Seller Financing Falls Short

Most amazon fba sellers turn to expensive loans when ecommerce cashflow gets tight. Here's why that's a mistake:

- High interest rates (15-30% APR) eat into already thin margins

- Personal guarantees put your personal assets at risk

- Fixed payment schedules don't align with seasonal amazon business cycles

- Debt accumulation hurts your credit and limits future financing options

Traditional amazon seller financing treats your cash problem like a loan problem. But what if there was a way to unlock immediate capital from your future sales without taking on debt?

The CGX Revolution: Turn Future Sales Into Immediate Cash

Consumer Goods Exchange (CGX) offers something completely different: a way to sell your future sales rights for immediate capital. No loans. No interest. No debt.

Here's how it works: Instead of borrowing money against your amazon investment, you sell the rights to future sales from specific products to investors on the CGX platform. You get cash today. Investors get returns from your future sales performance.

For Amazon FBA sellers, this means:

- Immediate capital to fund inventory and operations

- No monthly payments or interest charges

- No personal guarantees or credit requirements

- Cash flow that scales with your business growth

For investors, CGX provides:

- Direct exposure to ecommerce investment opportunities

- Diversified amazon investment portfolio across multiple sellers

- Returns tied to real consumer goods performance

- Alternative to traditional stock market volatility

Real-World CGX Implementation for E-Commerce Cashflow

Let's say you're an amazon fba seller with a winning product line generating $50K monthly in revenue. Traditional ecommerce financing would require you to:

- Apply for expensive loans (15-25% interest)

- Provide personal guarantees

- Make fixed monthly payments regardless of sales

- Risk your personal credit and assets

With CGX, you instead:

- List your future sales rights for that product line

- Set your terms and minimum pricing

- Connect with investors seeking ecommerce investment opportunities

- Receive immediate capital to scale operations

- Fulfill sales as normal while investors receive their allocated returns

The difference? You're not borrowing money: you're selling future revenue streams. This creates a true partnership between amazon business owners and investors.

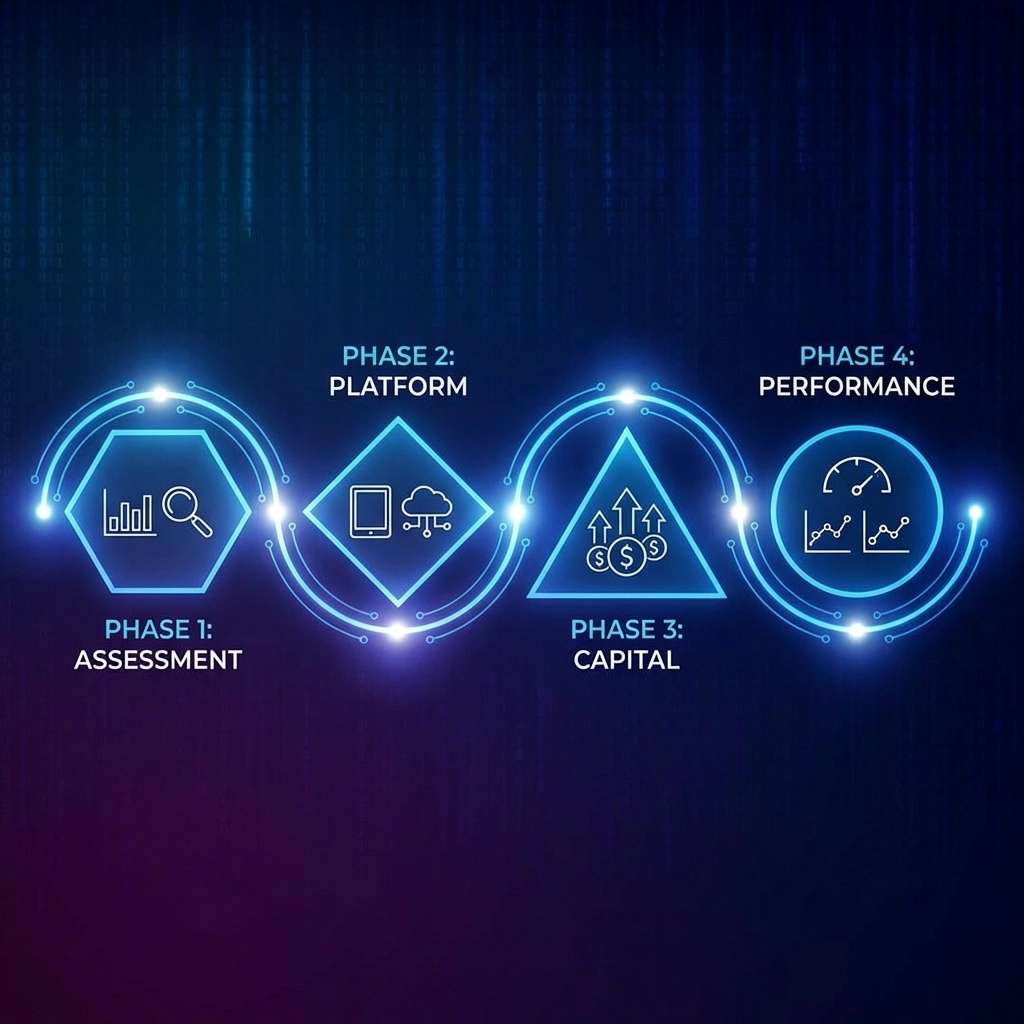

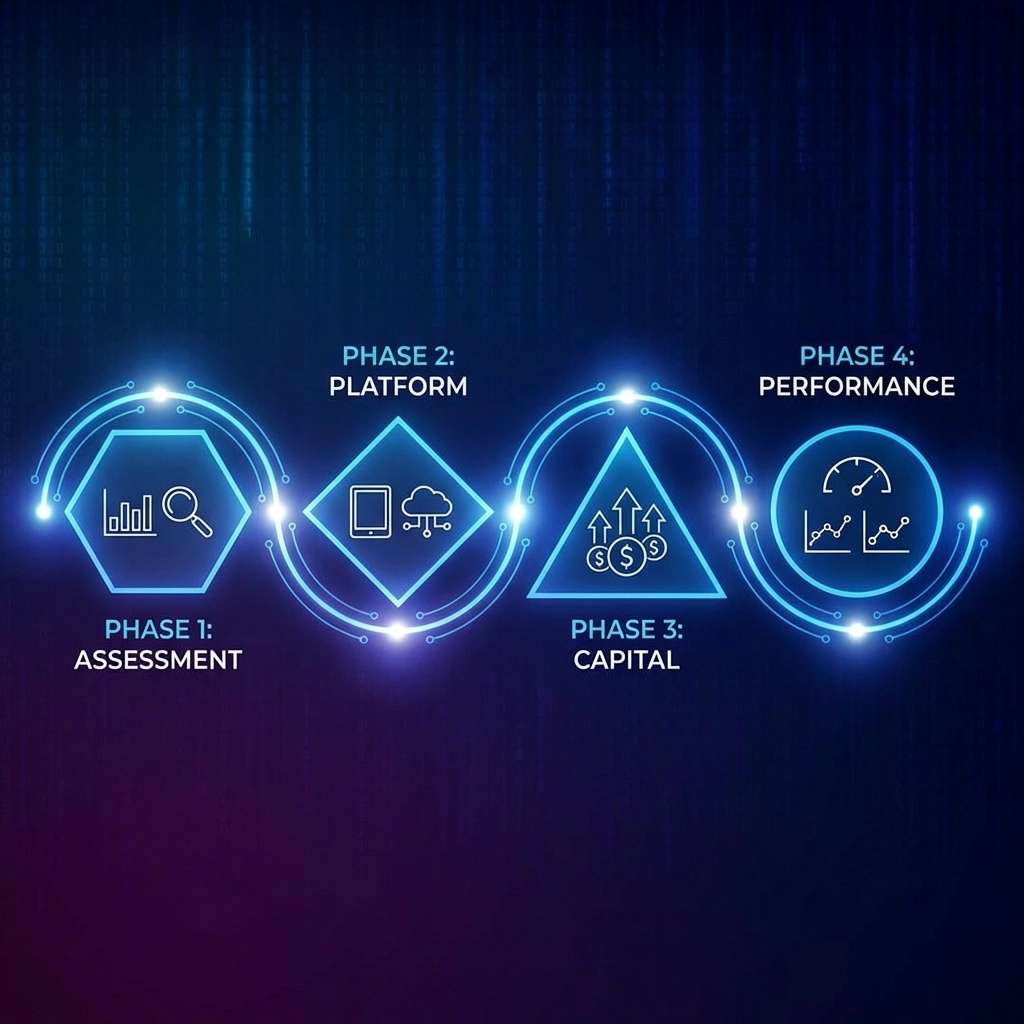

Step-by-Step Implementation Timeline

Week 1-2: Assessment and Planning

- Calculate your exact amazon cashflow gap using the fee increases

- Identify your strongest-performing product lines for CGX listing

- Gather 6 months of sales data and performance metrics

- Register on the CGX platform and complete seller verification

Week 3-4: CGX Listing Creation

- Create detailed listings for your future sales rights

- Set competitive pricing that attracts ecommerce investment

- Upload performance data and growth projections

- Connect with potential investors through the platform

Week 5-6: Capital Deployment

- Receive immediate capital from successful matches

- Deploy funds for inventory purchases ahead of payout delays

- Scale advertising spend to maximize sales velocity

- Optimize operations to meet investor return expectations

Week 7-8: Performance Optimization

- Monitor sales performance and investor returns

- Adjust operations to maximize both seller profits and investor satisfaction

- Scale successful products and list additional future sales rights

- Build long-term relationships with amazon investment partners

Advanced Strategies for Maximizing CGX Results

Diversify your future sales portfolio. Don't put all future sales rights with one investor. Spread across multiple investors to reduce concentration risk and increase negotiating power.

Target seasonal opportunities. List future sales rights for Q4 holiday seasons when ecommerce cashflow demand peaks and investors seek higher returns.

Leverage data transparency. The more performance data you provide, the higher prices investors will pay for your future sales rights. Transparency creates trust and premium valuations.

Build investor relationships. Successful partnerships lead to repeat investment and better terms for future amazon business growth.

Why CGX Beats Traditional Amazon Seller Financing

Traditional financing focuses on your past credit history. CGX focuses on your future sales potential. This creates better alignment between your business growth and your capital access.

Traditional approach: Borrow $50K at 20% APR. Pay $60K over 12 months regardless of sales performance.

CGX approach: Sell $50K in future sales rights. Investors get returns tied to actual performance. You keep upside beyond agreed returns.

The math is simple: Would you rather pay guaranteed interest regardless of performance, or share actual returns with partners who want you to succeed?

Getting Started with CGX: Your Next Steps

Ready to solve your ecommerce cashflow problems without debt? Here's how to begin:

For Amazon FBA Sellers:

- Visit CGX to explore seller opportunities

- Calculate your immediate capital needs and identify strong product lines

- Complete the seller application with 6 months of performance data

- Create your first future sales listing and connect with investors

For Investors:

- Explore CGX investment opportunities across diverse amazon business categories

- Review seller performance data and growth projections

- Build a diversified ecommerce investment portfolio

- Start earning returns from real consumer goods sales

The Future of E-Commerce Capital is Here

Amazon's 2026 changes aren't going away. Fee increases and payout delays are the new reality for amazon fba sellers. You can either adapt with innovative solutions like CGX, or watch your amazon investment returns get crushed by expensive traditional financing.

CGX represents the future of ecommerce financing: where sellers and investors partner for mutual success instead of borrowers paying guaranteed interest to lenders.

Your amazon business deserves better than high-interest loans and personal guarantees. Discover how CGX can transform your ecommerce cashflow from a constant struggle into a competitive advantage.

Visit CGX today and join the revolution in amazon seller financing. Your future sales are worth more than you think.

0 Comments